Understanding Bank Repo Cars: Buying Directly from Lenders

It’s important to understand what bank repo cars are. They’re the result of borrowers who fail to make payments on their auto loans. Banks and credit unions often have to repossess vehicles. This process involves taking back the car from the borrower. The following lenders frequently deal with repossessing vehicles for non-payment, and they all have their unique ways of handling repossessions and remarketing those vehicles. Many of them have a option where you can buy them back directly from the lender and save.

Capital One undeniably serves as a major player in the auto loan market. When they repossess a vehicle, they promptly work to remarket it. In fact, they often sell these repos directly to the public through auctions, which significantly helps consumers find great deals. As a result, buyers can enjoy prices that are hard to beat, while also eliminating middleman costs altogether. Therefore, purchasing a repo car from Capital One can lead to substantial savings and valuable options for buyers.

2. Bank of America Bank Repo Cars

Bank of America follows a well-established and efficient process for handling repossessions. They consistently strive to remarket these vehicles, which, in turn, allows buyers to purchase them without incurring extra fees. This efficiency not only saves time but also creates a positive experience for consumers. Thus, customers enjoy a streamlined process that makes it an attractive option for savvy buyers seeking quality vehicles at lower prices.

3. Chase Bank Repo Cars

Chase Bank also deals with repossessed vehicles and offers a straightforward process for selling repos back to consumers. Consequently, this approach effectively eliminates middlemen, saving buyers money in the process. As a result, it becomes more affordable for consumers to purchase a quality vehicle directly from the bank. Moreover, Chase Bank provides a wide range of options, which further enhances the buying experience.

4. Toyota Financial Services Repos

Toyota Financial Services actively manages repossessed vehicles from their auto loans. They focus on remarketing these cars directly to customers, ensuring a seamless buying experience. Consequently, buyers often discover better prices when purchasing directly from Toyota, which enhances the value of their investment. Moreover, this direct access fosters trust, making it easier for buyers to feel confident in their decisions.

5. Ally Financial Repos

Ally Financial stands out as a leader in auto financing. They work diligently to sell repossessed vehicles directly to consumers, thereby ensuring a straightforward process. Furthermore, their commitment to transparency significantly helps buyers feel confident in their purchasing decisions. This focus fosters trust and reliability throughout the buying process, allowing consumers to navigate their options with ease.

6. Navy Federal Credit Union Repo Cars

Navy Federal Credit Union proudly provides repossessed vehicles for sale exclusively to its members. They take great pride in offering quality vehicles at competitive prices, which makes them an excellent choice. As a result, this creates a fantastic opportunity for savvy buyers seeking exceptional value and reliability. Additionally, their emphasis on customer service enhances the overall buying experience for members.

7. Carvana Repos

Carvana, renowned for its convenient online car-buying process, also handles repossessions effectively. They list these vehicles on their user-friendly platform, giving buyers direct access to great deals. This direct access not only eliminates middlemen but also avoids any associated fees, ultimately benefiting the buyer. Consequently, Carvana makes it easier for consumers to find the right vehicle at a competitive price.

8. Ford Motor Credit Company Repos

Ford Motor Credit Company effectively repossesses vehicles and sells them back directly to consumers. This direct sale process allows buyers to secure great deals on quality cars, making it an attractive option. Moreover, their commitment to customer service ensures a smoother purchasing experience, which buyers truly appreciate. As a result, Ford Motor Credit Company creates a win-win situation for both the bank and the consumer.

9. Autopay Repos

Autopay is another lender that actively deals with repossessions and works diligently to remarket these vehicles effectively. This effort provides consumers with valuable opportunities to save money. Additionally, their focus on customer service significantly enhances the overall buying experience for potential buyers. Therefore, those interested in purchasing a repo vehicle from Autopay can feel confident in their decision.

10. GM Financial Repo Cars

GM Financial repossesses vehicles for non-payment and sells them directly to consumers. Their unwavering commitment to customer satisfaction makes it easier for buyers to find great deals. This direct selling method not only saves time but also helps buyers avoid unnecessary fees, creating a more positive experience. Consequently, GM Financial’s focus on transparency and efficiency attracts numerous buyers looking for quality vehicles.

11. Hyundai Motor Finance Repos

Hyundai Motor Finance efficiently manages repossessions and remarks their vehicles directly to consumers. They focus on providing buyers with quality options and a variety of vehicles. As a result, this direct access allows consumers to explore a wide range of options without any hassle or confusion. Furthermore, Hyundai’s dedication to customer service enhances the overall purchasing experience.

12. PNC Bank Repo Cars

PNC Bank actively deals with repossessions, making it easy for consumers to buy directly from them. This approach effectively eliminates unnecessary fees and commissions, ultimately benefiting the buyer. Therefore, customers often discover better value and quality in their purchases. Additionally, PNC Bank’s user-friendly processes streamline the buying experience, making it more accessible for all.

13. Santander Consumer USA Repos

Santander Consumer USA implements a clear and efficient process for repossessing vehicles and remarketing them effectively. They aim to make the buying process easy and transparent for all consumers. Consequently, buyers can navigate their options with confidence, ensuring informed decisions throughout their purchasing journey. Moreover, Santander’s commitment to customer satisfaction fosters trust and reliability, making it a preferred choice.

14. Wells Fargo Bank Repo Cars

Wells Fargo Bank handles repossessions and sells vehicles directly to buyers, which greatly simplifies the process. This strategy not only helps consumers save money but also ensures they receive quality cars. Additionally, this direct approach fosters a sense of trust between the bank and the buyer, making it easier to form a lasting relationship. Consequently, buyers can feel secure in their investment decisions.

15. Credit Acceptance Repos

Credit Acceptance specializes in financing for high-risk borrowers and actively manages repossessions. When they repossess vehicles, they focus on remarketing them directly to potential buyers. This method enhances accessibility for consumers seeking affordable options, ultimately benefiting everyone involved in the transaction. Thus, Credit Acceptance helps bridge the gap for buyers looking for reliable vehicles at lower prices.

16. Honda Financial Services Repos

Honda Financial Services effectively repossesses vehicles and provides an easy way for consumers to buy them back. Their straightforward process not only simplifies purchasing a repo car but also alleviates buyer concerns. Moreover, this user-friendly approach attracts more buyers who appreciate convenience and transparency, which enhances their overall satisfaction.

17. Nissan INFINITI Repos

Nissan INFINITI handles repossessions and offers a diverse selection of vehicles for direct sale. This process not only helps buyers find quality cars but also ensures there are no hidden fees. Consequently, this transparency makes it easier for consumers to make informed decisions throughout their buying journey, allowing for a more satisfying experience. Additionally, Nissan INFINITI’s commitment to customer service enhances the trustworthiness of their offerings.

Why Buy Directly from Banks?

When you buy a bank repo car, you save money. There are no middlemen, no commissions, and no extra fees. It’s like buying from a trusted friend or partner. You can feel secure knowing you are getting a fair deal.

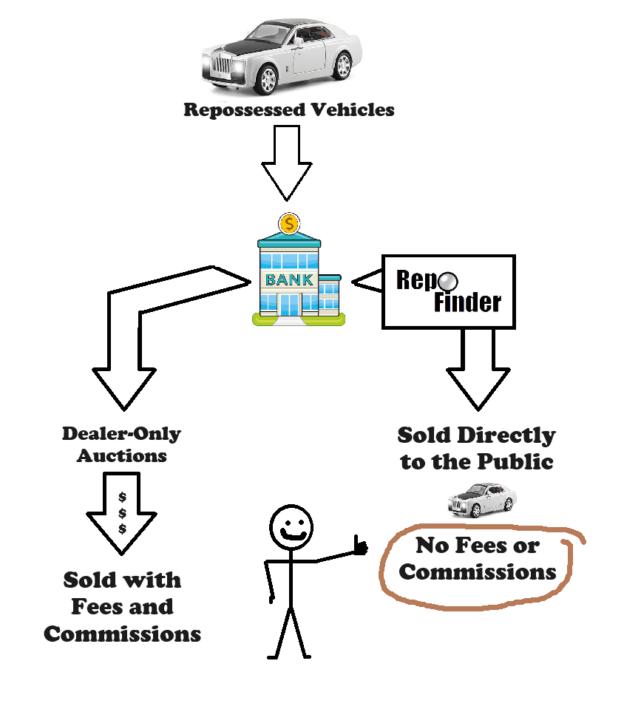

Discover Repos on RepoFinder.com

To find and purchase bank repo cars, use the free nationwide repo list at RepoFinder.com. This website is unique because it directly links buyers to banks. Unlike other platforms, RepoFinder does not take a commission or charge fees.

The Best Repos at Your Fingertips

You can learn more about the process of buying directly from banks by visiting RepoFinder.com. The site offers a variety of resources to guide you through every step. The repos that banks sell directly are often the best of the best. In contrast, salvage vehicles usually go to dealer-only auctions and scrap dealers.

Conclusion

In summary, buying a bank repo car can be a smart and cost-effective choice with plenty of options. With the ability to purchase directly from lenders like Capital One, Bank of America, and Wells Fargo, you can enjoy significant savings. Plus, using RepoFinder.com ensures you access the best deals without any hidden costs. Start your journey to finding a bank repo car today!