Where to Find Okaloosa County Teachers Federal Credit Union Repos

If you’re searching for affordable vehicles, boats, or real estate, Okaloosa County Teachers Federal Credit Union Repos (OCTFCU) has you covered. This credit union, based in Florida, offers repossessed property directly to the public. Buying repossessed assets is an excellent way to save money, avoid dealer fees, and find valuable items at lower prices. In this blog post, we’ll explore where to find OCTFCU repos and explain why RepoFinder.com is the perfect resource to start your search.

What Are Repos?

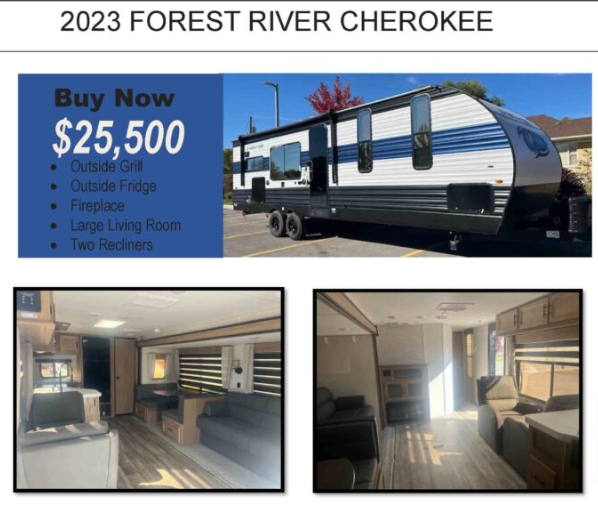

Repos, short for repossessions, are items seized by banks or credit unions when borrowers fail to pay their loans. These items can include cars, trucks, motorcycles, boats, RVs, ATVs, and even homes. Financial institutions like OCTFCU sell these repossessed items to recover the unpaid loan balance. For buyers, this creates an opportunity to purchase quality items at significantly discounted prices.

Why Buy Repossessed Property?

Buying repossessed items offers several benefits:

- Cost Savings: Banks and credit unions aim to recover the loan balance, not make a profit. This means lower prices.

- No Dealer Fees: Buying directly from a financial institution eliminates dealer markups and commissions.

- Diverse Selection: You’ll find a wide range of items, from cars and trucks to boats and real estate.

- Straightforward Process: Purchasing from a credit union is often simpler and more transparent than buying from a dealership.

If you’re a first-time buyer, don’t worry! The process is easier than you might think. Let’s dive into how you can find OCTFCU repos.

How to Find Okaloosa County Teachers Federal Credit Union Repos

Finding repossessed items from OCTFCU is simple and straightforward. Here’s a step-by-step guide:

1. Visit the OCTFCU Repos Page

OCTFCU maintains a dedicated page for repossessed items. You can view their available inventory by visiting https://okaloosafcu.org/repos-for-sale/. The page is updated regularly with the latest listings, so check back often.

2. Explore RepoFinder.com

RepoFinder.com is a valuable resource for anyone looking to buy repossessions directly from banks and credit unions. RepoFinder is unique because it connects you directly to institutions like OCTFCU, cutting out the middleman. Unlike dealer-only auction sites, RepoFinder provides free access to listings, making it the perfect place to start your search.

Check out their site here.

3. Compare Prices and Listings

Browse through available repos and compare prices. Most credit unions, including OCTFCU, provide detailed descriptions, photos, and contact information for their repossessions. This transparency allows you to research the item thoroughly before making a decision.

4. Contact the Credit Union

Once you find an item you’re interested in, contact OCTFCU directly. They can provide additional details, answer questions, and guide you through the purchasing process.

Tips for Buying Repo Vehicles

Buying a repossessed vehicle is different from shopping at a dealership. Follow these tips to make the process smoother:

1. Do Your Research

Before purchasing, research the market value of the vehicle. Use resources like Kelley Blue Book or Edmunds to compare prices and ensure you’re getting a good deal.

2. Inspect the Vehicle

Many repos are sold “as-is,” meaning there’s no warranty. Inspect the vehicle thoroughly or hire a mechanic to check it out.

3. Understand the Terms

Credit unions often require payment in full or financing through their institution. Make sure you understand the terms before committing.

4. Act Quickly

Repo listings often sell quickly due to their competitive prices. If you find something you like, don’t hesitate to reach out.

Why Choose RepoFinder?

RepoFinder is the ultimate starting point for finding repossessed property. Here’s what makes RepoFinder unique:

- Direct Connections: RepoFinder links buyers directly to banks and credit unions, like OCTFCU, eliminating commissions and middlemen.

- Free Access: Unlike dealer-only auction sites, RepoFinder is free to use.

- Comprehensive Listings: RepoFinder includes a wide range of repossessed items, from vehicles to real estate.

- User-Friendly Interface: The site is easy to navigate, making it simple for first-time buyers to search and compare listings.

No other website offers the same level of access to bank and credit union repossessions, making RepoFinder a one-of-a-kind resource.

A Brief History of OCTFCU

Okaloosa County Teachers Federal Credit Union was established to serve educators and their families in Okaloosa County, Florida. Over the years, OCTFCU has grown to serve a wider community, offering financial products and services to help members achieve their goals. Repossessions are just one of the many ways OCTFCU provides value to its members and the public.

Conclusion

Buying repossessed property from OCTFCU is a smart way to save money and find valuable items. By visiting their repos page or using RepoFinder.com, you can access high-quality vehicles, boats, and real estate at affordable prices. RepoFinder is the best resource for buyers, connecting you directly to financial institutions and eliminating unnecessary fees.

Whether you’re a first-time buyer or a seasoned pro, take advantage of these resources and start exploring repossessed properties today!