Are you searching for a great deal on a car, truck, boat, or even real estate? Utah Heritage Credit Union repos could be the perfect opportunity. UHCU is a trusted financial institution in Utah, and their repossessed properties are worth checking out. These deals are often hidden gems, offering significant savings. Here’s a guide to help you navigate the process.

What is Utah Heritage Credit Union?

Utah Heritage Credit Union, or UHCU, has served Utah residents since 1969. It’s a member-owned financial institution dedicated to providing excellent service and financial products. Over the years, UHCU has gained a reputation for helping its members achieve their financial goals. One of the lesser-known benefits they offer is access to repossessed vehicles and property at competitive prices.

Why Do Banks and Credit Unions Sell Repossessed Vehicles?

When borrowers default on loans, banks and credit unions often repossess the property to recover their losses. This includes cars, trucks, motorcycles, RVs, boats, and even homes. Once the property is repossessed, the financial institution will sell it to recover the remaining loan balance. Since they aren’t looking to make a profit, these items are often sold at lower-than-market prices.

The Benefits of Buying Repossessed Property

1. Lower Prices

Repossessed vehicles and properties are typically sold at a discount. This is because banks and credit unions aren’t dealerships; they just want to recoup their money. This can translate into thousands of dollars in savings.

2. No Dealer Markup or Commissions

When you buy directly from a credit union, there’s no middleman. This means no extra fees or commissions that dealerships often add.

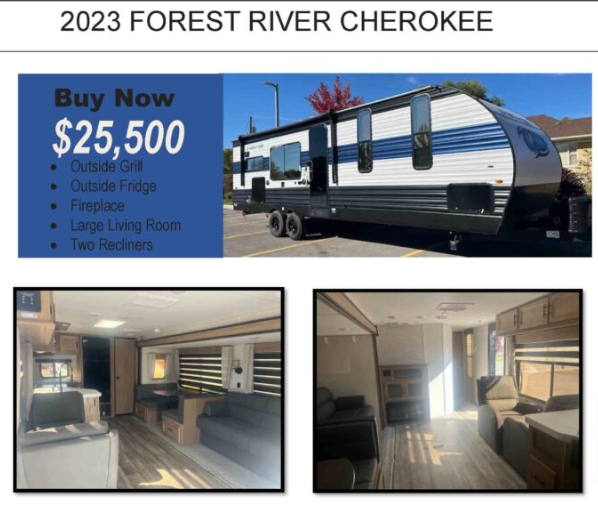

3. Wide Variety

Repossessions include cars, trucks, motorcycles, RVs, boats, ATVs, and even real estate. This wide selection increases your chances of finding exactly what you need.

4. Transparent Process

Credit unions like UHCU are transparent about the condition and history of their repossessed items. You can review the details before making a decision.

Where to Find Utah Heritage Credit Union Repos

Finding UHCU’s repossessed vehicles and properties is easier than you think. Here are the steps:

1. Visit Their Repossession Page

Start by visiting Utah Heritage Credit Union’s repossessed autos page. They update this page regularly with available repossessions. Bookmark it and check often for the latest deals.

2. Use RepoFinder.com

RepoFinder.com is a comprehensive resource for finding repossessed vehicles and property. Their blog offers tips and insights on buying bank and credit union repos. It’s an excellent starting point if you’re new to the process.

3. Contact UHCU Directly

Call or visit Utah Heritage Credit Union to ask about their current repossessions. Their staff can provide detailed information and help you understand the buying process.

What to Expect When Buying UHCU Repossessed Vehicles

If it’s your first time, the process might seem intimidating. Here’s what to expect:

1. Inspection

Repossessed vehicles are sold “as-is.” This means you’re responsible for checking their condition. Bring a mechanic or someone knowledgeable about cars to ensure you’re getting a good deal.

2. Financing Options

You can often finance your purchase directly through the credit union. This is convenient and can save you time.

3. Bidding or Negotiation

Some repossessions are sold through auctions, while others have fixed prices. Find out how UHCU handles their sales and be prepared to negotiate if allowed.

4. Paperwork

Once you agree to the purchase, you’ll need to handle the paperwork, such as transferring the title and arranging insurance.

Tips for Buying UHCU Repossessed Vehicles and Property

1. Do Your Homework

Research the market value of the vehicle or property you’re interested in. This ensures you’re getting a fair price.

2. Inspect Thoroughly

As mentioned earlier, repossessed items are sold as-is. Be thorough in your inspection to avoid surprises later.

3. Set a Budget

Stick to your budget and don’t get carried away, especially if you’re bidding in an auction.

4. Act Quickly

Repossessed items often sell fast because of their lower prices. If you find something you like, act quickly before someone else grabs it.

Frequently Asked Questions

Can I Test Drive a Repossessed Car?

It depends on the credit union. Some allow test drives, while others do not. Call UHCU to confirm their policy.

Are Repossessed Vehicles in Good Condition?

Repossessed vehicles vary in condition. Some are nearly new, while others may need repairs. Always inspect before buying.

Do Repossessed Vehicles Come with a Warranty?

Typically, no. These vehicles are sold as-is. Consider purchasing an extended warranty for peace of mind.

How Do I Finance a Repo Vehicle?

Many credit unions, including UHCU, offer financing options for repossessions. Check with them to learn about their terms.

Start Your Search Today

Finding great deals on repossessed vehicles and property doesn’t have to be complicated. Start with Utah Heritage Credit Union and explore their current listings. For even more options, visit RepoFinder.com, where you’ll find repossessions from credit unions and banks nationwide.

By understanding the process and knowing where to look, you can save thousands on your next purchase. Whether it’s a car, truck, boat, or real estate, repossessions offer unmatched value. Happy hunting!